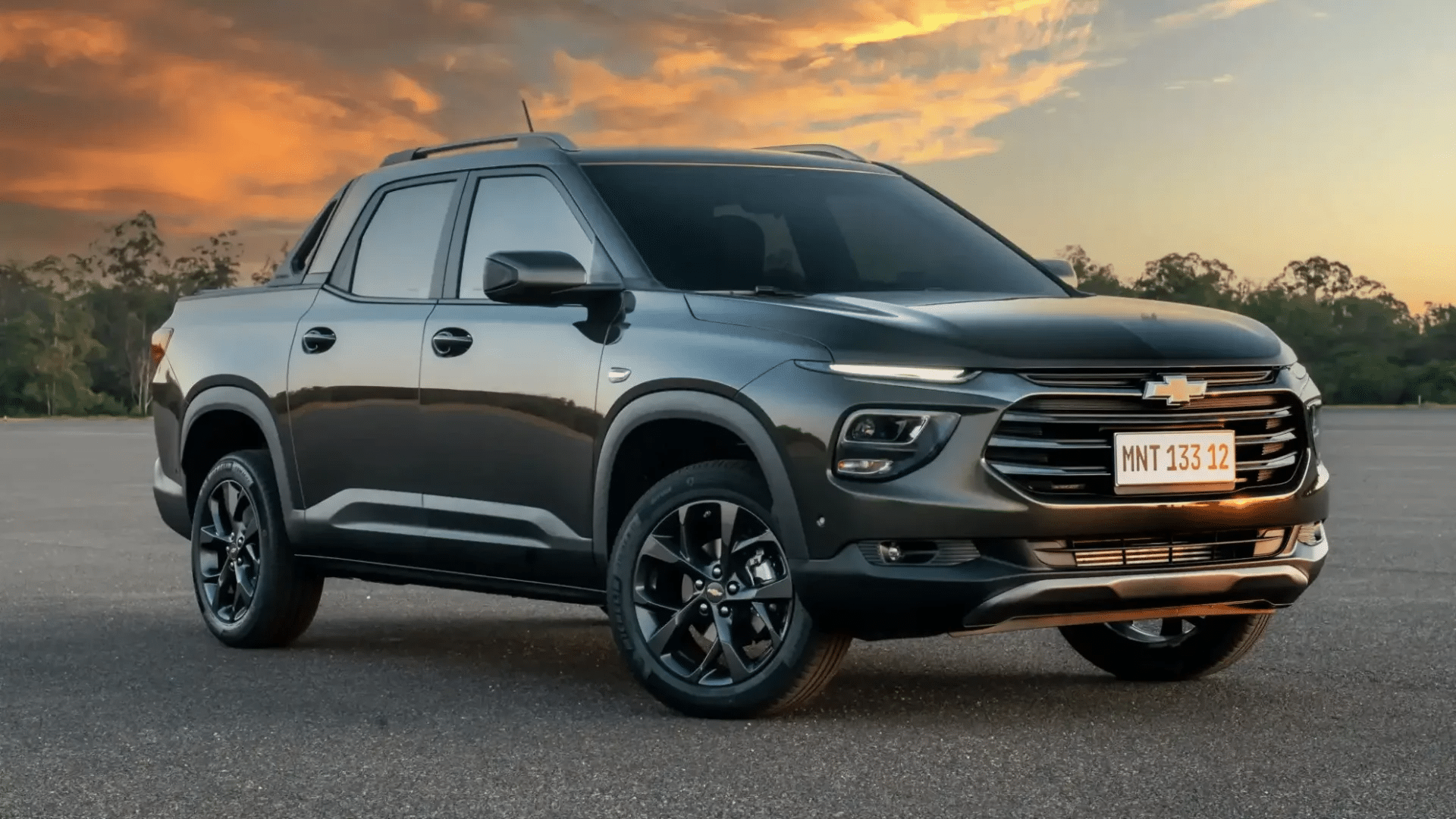

Your Guide to Auto Financing in the U.S. — Learn How to Choose the Right Loan

Anúncios

Auto financing can open the door to driving the car you want without draining your savings.

But with so many lenders, terms, and rates available, knowing how to choose the right loan is essential for protecting your budget and your long-term financial health.

-

Know Your Credit Score+

Your score is the starting point for rate offers—higher scores usually get better APRs.

-

Shop Rates Within a Short Timeframe+

Multiple auto loan inquiries within 14–45 days count as one for credit purposes.

-

Consider Preapproval+

It strengthens your negotiation position at the dealership.

-

Read the Fine Print+

Watch for prepayment penalties, hidden fees, or add-on costs.

Top Auto Loan Options in the U.S.

Bank of America Auto Loans: Stable rates and refinancing programs.

Chase Auto Loans: Nationwide dealer integration and incentives for existing customers.

PenFed Credit Union: Low APR for members with flexible terms.

LightStream: No restrictions on vehicle age or mileage.

Capital One Auto Loans: Digital tools and prequalification with no credit impact.Traditional Bank Loans – Reliable, with in-person service.

Credit Union Loans – Often lower rates, especially for members.

Online Lenders – Fast approvals and competitive offers.

Manufacturer Financing – Special rates tied to brand promotions.

Buy Here Pay Here – Easy approval but high cost—use cautiously.

Better Negotiations

Preapproval gives you leverage.

Lower Interest

Shopping rates can save thousands over the loan life.

Confidence in Budget

Knowing total costs avoids surprises.

Avoiding Bad Deals

Recognize overpriced add-ons.

Credit Score Growth

On-time payments boost your score.

How Auto Loans Affect Credit & Finances

A well-managed auto loan builds credit history and improves your score.

Missed or late payments harm your credit and can lead to repossession.

Shopping for loans responsibly and paying on time keeps debt manageable.

You will stay on our website.